The Berkshire Group is a management consulting firm that has been providing advisory services since 1998. We focus on assignments involving 1) Predictive Modeling, 2) Transaction Support Services, 3) Data and Analytics, 4) Litigation and Dispute Resolution Services and 5) Forensic Accounting and Fraud Examination Services. We also provide books and publications.

Our professional staff are experts in predictive modeling, computer programming, financial analysis, data management and analysis, fraud examination, forensic accounting, and loan file due diligence.

Berkshire Group’s core client base includes financial institutions, manufacturing firms, services firms, transportation companies, law firms, government agencies, and others. We provide services to clients primarily located in the US, Puerto Rico and Latin America.

Categories of Services Provided

Summary Descriptions

Mortgage Industry – Are We Over the Rapids ?

Recent Trends in Mortgage Industry Over the 17 months ranging from March, 2022 to July, 2023, the Federal Reserve (Fed) raised the Fed Funds rates to their highest levels in more than fifteen years. In recent weeks, the markets have been betting that the Fed will hold interest rates unchanged for the near future, and […]

Performance of 30 Yr. Fixed Rate Mortgages in UMBS 2021 – 23

Recent Performance of 30 Yr. Fixed Rate Mortgages Prepayment speeds on mortgages in UMBS securities from all reviewed origination years have varied greatly by vintage over the last 30 months. 2021 and 2022 vintage CPRs have been below 10% the entire time. Older vintages CPRs have been below 10% for six to twelve consecutive months, […]

Metrics on Mortgages in Ginnie Mae Insured Transactions 2021-23

With material rapid increases in loan rates, the aggregate monthly volume of new Ginnie Mae (GNMA) insured mortgages decreased by roughly 80% during the study period. Origination volumes of Fannie Mae and Freddie Mac loans in Uniform Mortgage Backed Securities (UMBS) have also been declining at a steep pace. The rate of decline of GNMA […]

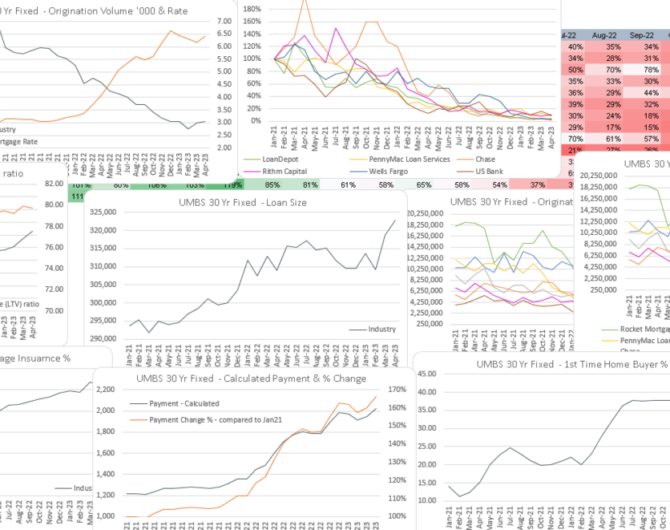

Mortgage (UMBS) Origination Changes 2021-23

With residential mortgage rates again topping 7% this week, we thought it would be interesting to look at some key industry timeseries metrics, and those of a few originators to see how they are faring in this challenging lending environment. In this article we will look at production sold into Freddie and Fannie securitizations. Next […]