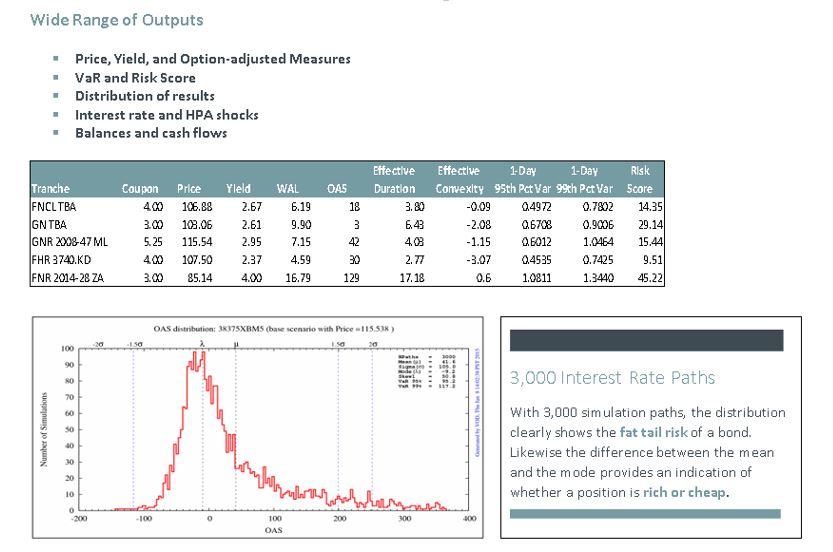

Berkshire uses assumptions derived from its collateral database for internal modeling purposes and for completing predictive modeling assignments. Some clients, however, want to search the data for their own terms, on their own terms. We offer that flexibility, and we offer data hosting and analysis as a subscription service to those clients. If however, you desire expert analysis, a fresh perspective, and unique solutions, Berkshire offers those services through our Predictive Modeling service.

Data Platform Overview

Berkshire tracks monthly performance on more than 20 million privately securitized loans (2.5 million active) and ~250 million agency mortgages (41.5 million active.) Some of the highlights of our data platform are:

- Massive, up-to-date MBS and ABS databases (Agency data going back 30+ years, non-agency going back 15+ years)

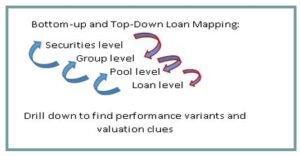

- Loans mapped to pools, groups and CUSIPs (except for CAS and STACR loans originated before agencies started provided loan level detail by security)

- Secure web hosting on our public cloud platform (powerful, easy-to-use tools for defining queries, slicing and dicing)

- Rich data field content, continuously gathered, updated, normalized, verified, and validated (agency data updated monthly upon release, non-agency data within hours or days after release, depending on shelf)

- Pre-defined and custom reporting and exports to Excel

- Custom model building

Coverage of loans in over 7,000 Non-Agency Securitizations

- Prime

- Subprime

- Alt-A

- Jumbo

- HELOC

- Manufactured Housing – Chattel and Real Estate

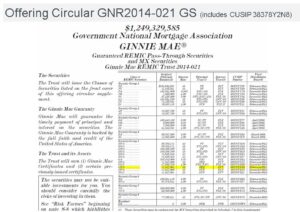

Complete Coverage of Agency Products

- FNMA, FHLMC, GNMA

- Megas, Giants, and Platinums

- CMOs and Re-REMICs

- CRT – STACR, CAS, ACIS, CIRT

- IO/PO Strips

- Reverse mortgages

- Pool level

- Loan level performance data

- Loan level credit data

Features

- Monthly Agency updates available within 60 seconds of the releaseof monthly factor tapes

- View results within browser or download

- Save queries and variable sets

- Excel plug-in available

- See the population of pools or loans underlying a collateral filter

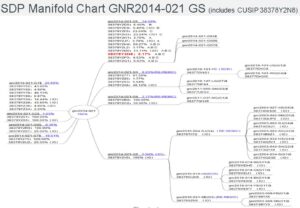

- Access securities by pool, CUSIP, class name, strip ID, or CMO collateral group

Real Time Ad-Hoc Analysis

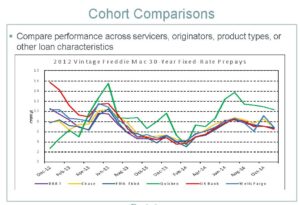

- Create custom queries, filters, and reports

- Analysis of cohorts or securities

- Time series analysis

- Aging curves

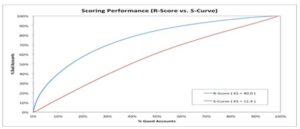

- Refinancing S-curves with spreads to current mortgage rates or user defined rates

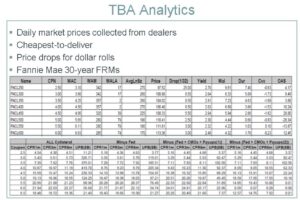

- TBA dollar roll analysis; break-even drops and financing rates

Intuitive, Yet Powerful GUI Querying Screens

- Enhanced web interface

- Easy to use query builder

- Search engine for historical queries

- User defined functions and variables

- Filter and segment by any available variable

- Optional ability to access data with your own python programs

Derived Variables

- Mark-to-market current LTV using FHFA home price indices at the CBSA level

- Prepayment, default, delinquency, and buyout scores for refinance and turnover

- Refinance burnout measures

- Cheapest-to-deliver TBAs

- Float and tradable pass-throughs

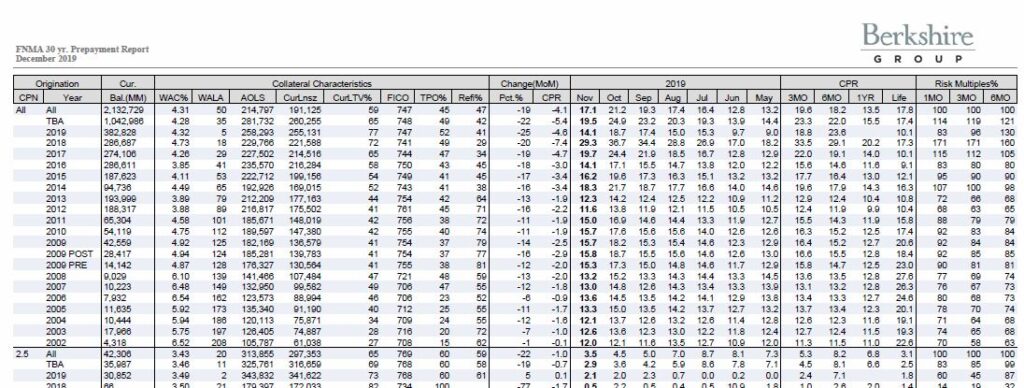

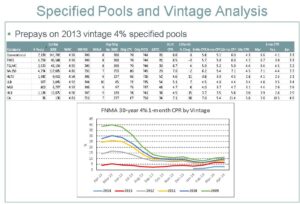

Full Suite of Prepayment Reports

- Flash prepayment

- Generics by vintage

- Servicer, issuer, and geographic indices

- Issuance volumes

- Specified pools

- Strip and mega pool performance

- Segmentation by occupancy, property type, or loan purpose<

Economic Time Series Data

- Freddie Mac Primary Mortgage Market Survey

- Hybrid ARM rates

- MBA application data

- MBA delinquency survey

- FHFA and Case-Shiller HPI data

- Interest rates; CMT, LIBOR, swaps, prime

- Unemployment rates

Expert Insights

- Expertise from our team of industry veterans

- Advisory services available to assist in interpreting results or for creating custom queries and reports