Berkshire Group provides specialized support services for asset acquisition, sales, and securitization transactions in the residential mortgage loan industry. Leveraging proprietary loan performance data and AI-enhanced analysis techniques, we deliver insight-driven guidance to buyers, sellers, and intermediaries navigating complex financial asset transactions.

We also offer interim management personnel and strategic support for companies in bankruptcy or financial restructuring—applying Retrieval-Augmented Generation (RAG) systems and predictive modeling to improve valuations, auction outcomes, and restructuring plans.

Residential Mortgage Loan Transaction Support Services

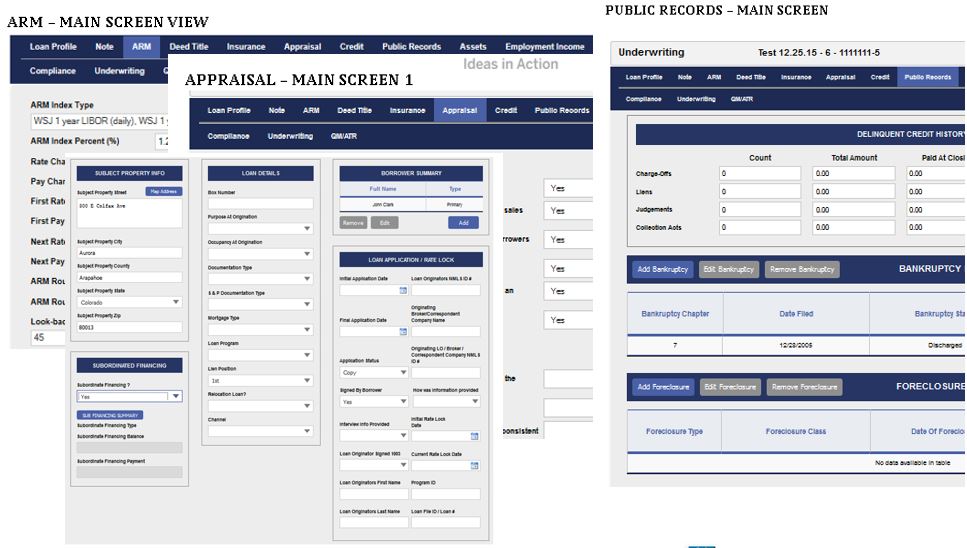

- Designing and refining underwriting parameters, product structures, and pricing tiers.

- Pricing pools of loans in whole loan transactions:

- Reviewing program guidelines and origination history

- Tape cracking, data cleansing, and deep analytics

- Risk-adjusted pricing with AI-enhanced scoring models

- Loan file-level due diligence

- Document negotiation and drafting for purchases, servicing, and securitizations.

- Clean-up call evaluation and auction management, including buyer outreach, document prep, and price validation..

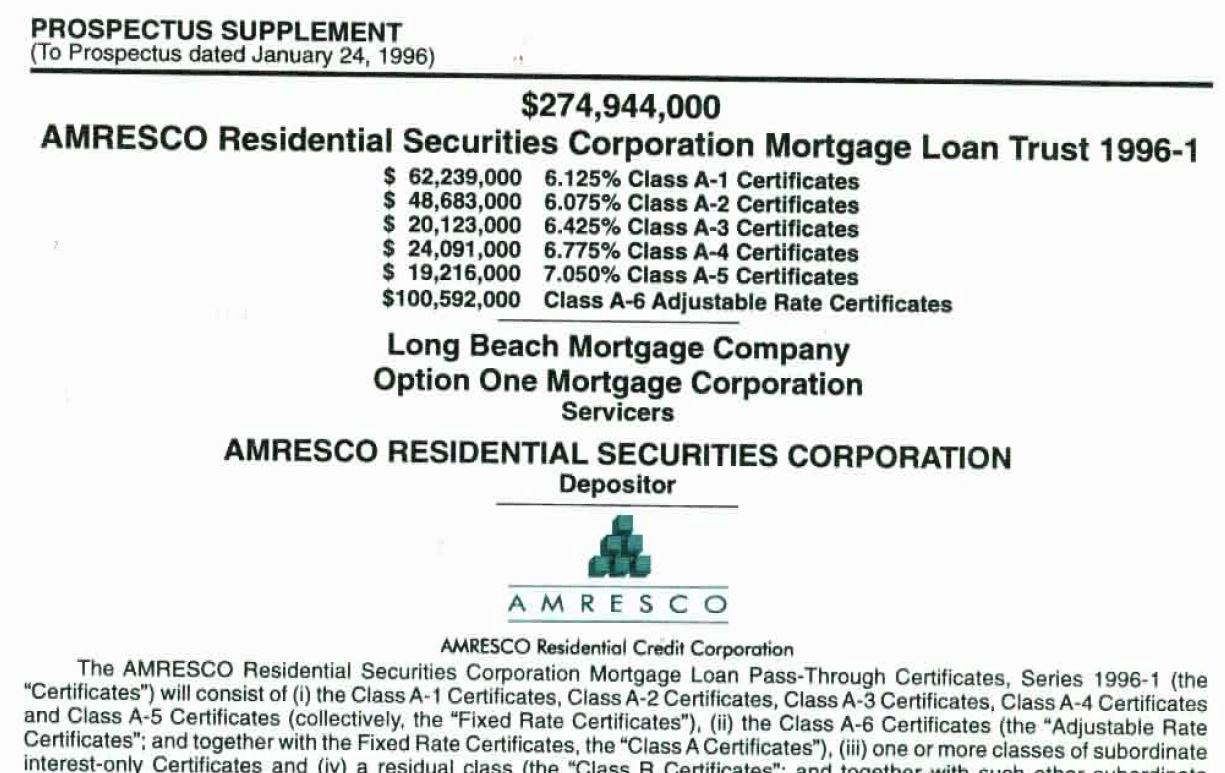

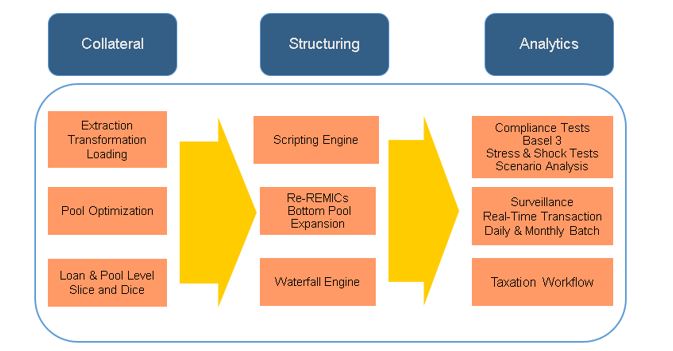

- End-to-end securitization support:

- Pool selection and optimization

- Cash flow modeling (loan and bond)

- Deal document negotiation

- Post-securitization surveillance

- Valuing residential, consumer, and commercial loans in M&A contexts using proprietary models and macroeconomic overlays.

With decades of direct transaction experience and a comprehensive performance dataset covering 250+ million mortgage loans, Berkshire’s transaction support is data-driven, tailored, and informed by modern AI techniques—including integration of RAG systems for document understanding and valuation modeling.

Bankrupt Company Support Services

Berkshire provides expert guidance to bankruptcy trustees, creditors, and company management seeking to restructure or liquidate financial asset portfolios.

- Deploying interim professionals with expertise in data analytics, finance, and operations.

- Evaluating and marketing financial assets, utilizing AI-enhanced valuation models and buyer engagement strategies.

Our goal is to maximize recovery, ensure transparency, and streamline the transition process by applying data-backed methodologies and decision tools, including proprietary cohort analysis and AI consulting frameworks.

Ready to discuss a transaction, valuation, or restructuring?

<a href=”https://www.bglp.com/contact/”>Contact us today</a> to explore how Berkshire Group can support your mission.