“All models are wrong, but some are useful.” — George E.P. Box

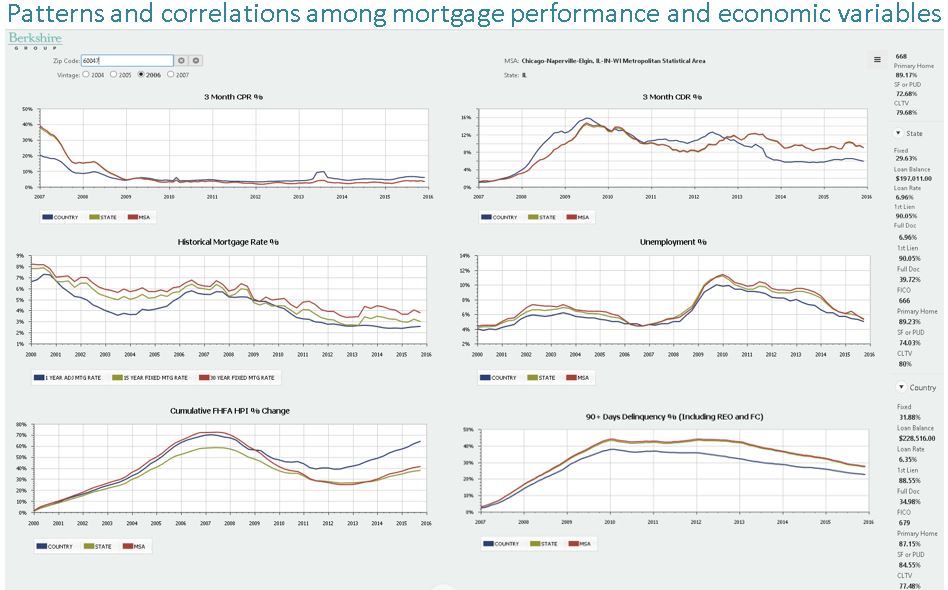

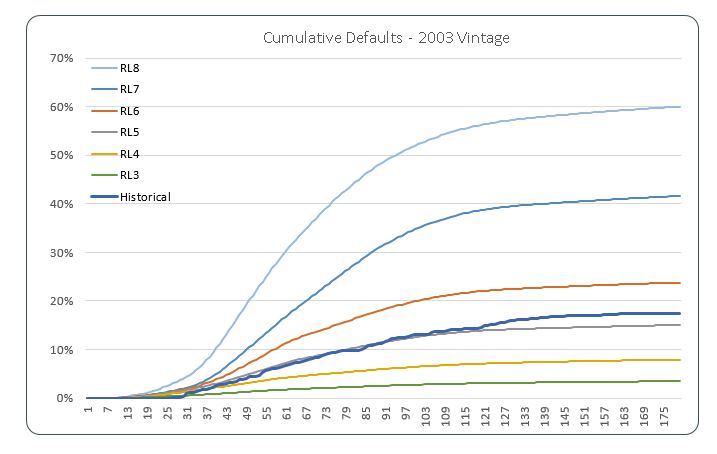

Predictive modeling is a core capability of The Berkshire Group. We specialize in forecasting loan performance metrics such as balances, cash flows, delinquencies, and losses. Our proprietary modeling tools are employed across a wide range of client engagements, and we also design customized models tailored to specific client needs.

A detailed overview of our modeling approach is available here.

Applications of Predictive Modeling

- Loan loss forecasting and reserve analysis

- Regulatory stress testing

- Loan pricing and portfolio optimization

- MSR (Mortgage Servicing Rights) valuation

- MBS and ABS pricing

- Derivative instrument valuation

- Capacity planning for financial institutions

Predictive modeling supports many of our broader advisory services, including:

- Transaction support

- Litigation analytics and dispute resolution

- Valuation for financial reporting and advisory work

Modeling Assumptions & Data Sources

We base many of our modeling assumptions on proprietary databases of residential mortgage loan performance. Our systems track over 44 million active residential mortgage loans and historical performance data on an additional 215 million loans.

Other Asset Classes

We also maintain longitudinal data on the following consumer loan types:

- Automobile Loans

- Prime / Subprime

- New / Used

- Time-share Loans

- Manufactured Housing Chattel Loans

- Single-wide / Multi-wide / Tiny Homes

- New / Used

- Community-based and privately owned lots

- Other Consumer Loans

These asset classes have unique behavioral and depreciation characteristics, which we incorporate into our modeling to enhance forecast accuracy.

Macroeconomic Factor Integration

Our models incorporate relevant macroeconomic indicators that influence borrower behavior and credit performance. This integrated approach allows our clients to:

- Enhance capital planning

- Improve risk-adjusted returns

- Identify credit loss vulnerabilities earlier

At Berkshire Group, we help clients analyze the past, understand the present, and predict the future with confidence.