We develop custom financial models for forecasting loan and portfolio performance, including balances, cash flows, delinquencies, and expected losses. Our team supports whole loan and MSR valuations across various market conditions.

- Customized performance projections

- Prepayment and default curves

- Loss forecasting and reserve requirement analysis

- Whole loan, MSR, and structured asset valuations

- Stress testing under alternative scenarios

- Model validation and documentation

- Stress Testing

- Model Validation Services

We provide expert assistance throughout the life cycle of loan, MSR, and structured securities transactions—from diligence to closing.

- Bid preparation and evaluation

- Asset sales, securitizations, and cleanup calls

- Transaction documentation review

- Operational and loan-level due diligence

- Custom valuation model development

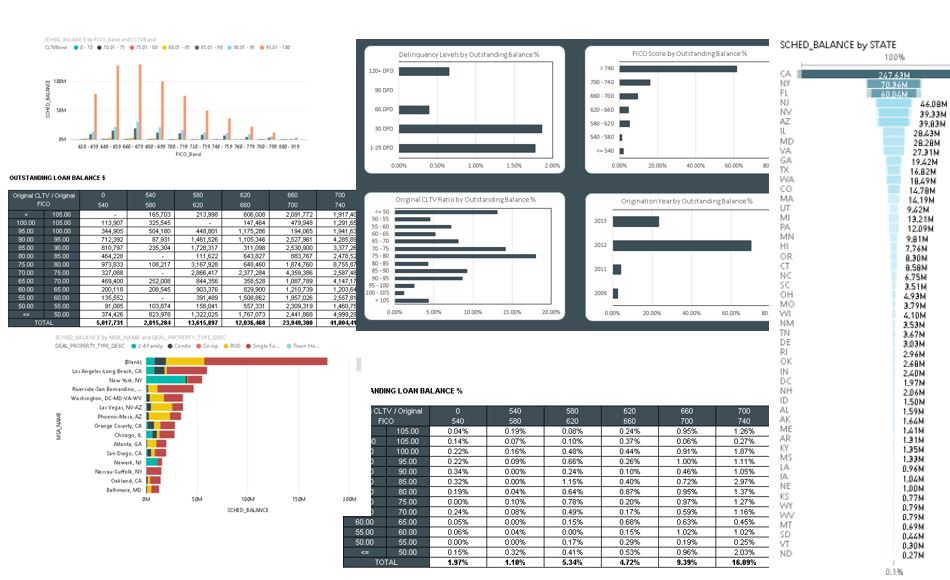

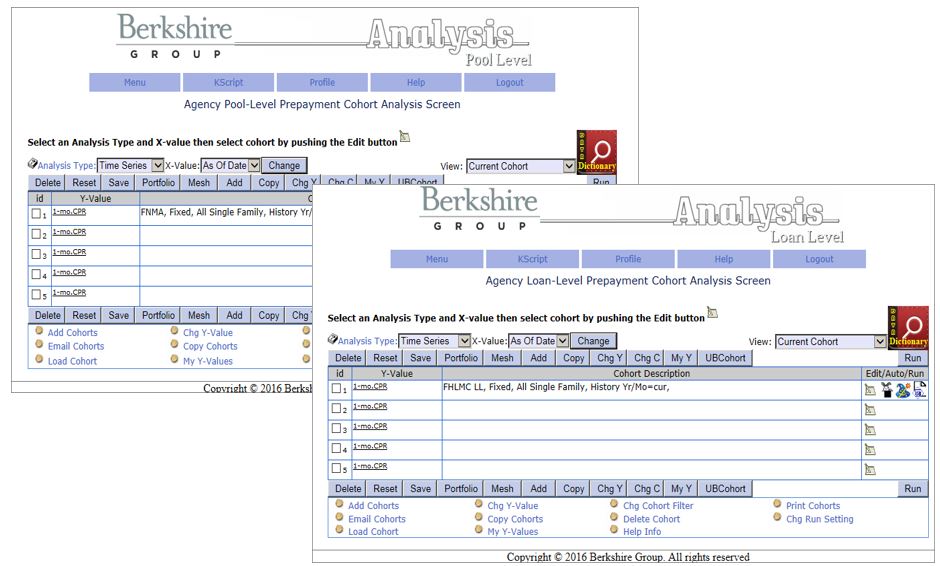

We offer proprietary data platforms and client-custom analytics for agency and non-agency mortgage portfolios. Our tools enable granular exploration and cohort-based analysis.

- Agency and non-agency loan data platforms with interactive filtering

- Portfolio analytics for client holdings

- Custom prepayment and credit scoring models

- Specified pool and credit transaction analytics

We assist law firms and clients with expert-level financial analysis, reporting, and testimony in complex litigation matters. Our team produces defensible analytics used in expert reports, rebuttals, and court testimony.

- Forensic and historical financial analysis

- Customer and transaction file review

- Expert and rebuttal report preparation

- Pre-litigation consulting and damage modeling

- Collaboration with legal and litigation specialists

We conduct detailed forensic investigations, supporting litigation, regulatory response, and internal inquiries. Our services are frequently used by law firms, lenders, and government entities.

- Fraud investigation and financial forensics

- Customer and asset file due diligence

- Litigation and bankruptcy support

- Regulatory compliance reviews

- Insurance claims, insolvency, and OSINT research

Analyst developing AI system in secure environment

BGLP helps clients understand and evaluate artificial intelligence platforms—especially Retrieval-Augmented Generation (RAG) systems—used for internal search, decision support, and customer-facing tools. Our role is advisory: we explain the components, assess feasibility, and help organizations prepare to safely and effectively use AI within complex regulatory or operational environments.

- AI strategy and use case evaluation

- RAG system architecture and component explanation

- Document and data readiness planning

- Vendor landscape and capability review

- Governance, risk, and compliance considerations